If you want to simplify how you make payments and you don’t want to carry credit cards and cash, it’s time to consider loading your card to a digital wallet. Pick a digital wallet that suits your smartphone – Apple Pay, Google Pay or Samsung Pay – and make purchases at thousands of retailers using only your phone. This convenient, fast, and secure mobile payment option continues to grow increasingly popular, and this article outlines how to use it and why you should start utilizing a digital wallet.

How to Use It?

If you see a wave symbol on your card, you’re all set to start using contactless payments. Add your card to your mobile wallet so you can tap or wave your smartphone above the terminal to process the transaction fast and safe. You don’t have to select savings, cheque or credit as the transaction will automatically be charged to your credit card. You’ll know if it has gone through by the illuminated light and a display message will appear across the screen confirming the sale has gone through.

To make sure that the terminal accepts contactless payment, look for the following symbol:

Why Go Contactless?

Convenience

Contactless payments are faster than both cash and card transactions. You don’t have to waste time digging through your wallet trying to find your debit card as well as swipe, insert or enter PIN to complete the transaction (for small purchases). All you have to do is tap or wave your smartphone using a digital wallet at the checkout terminal. It takes a few seconds, and the purchase will then be authorized, processed and billed in the same secure way as your other transactions.

Security

Contactless payments run on near-field communication (NFC), a technology that enables your mobile phone to securely transmit and receive information over a short range of about 4 centimeters.

Another security benefit is that your card never leaves your hand, decreasing the risk of fraudulent activity. If someone finds your phone, they can’t just physically reach into it and pull out a credit card. To access your digital wallet, they will be required to pass additional authorization (Face ID, fingerprint, passcode, etc.)

No Extra Fees

Digital wallets typically offer all of this convenience for free. Some transactions, however, could come with a flat fee, such as reloading a prepaid card within the wallet from a different source, like a credit card. But, for most transactions, the convenience and simplicity of a digital wallet will not cost anything additional.

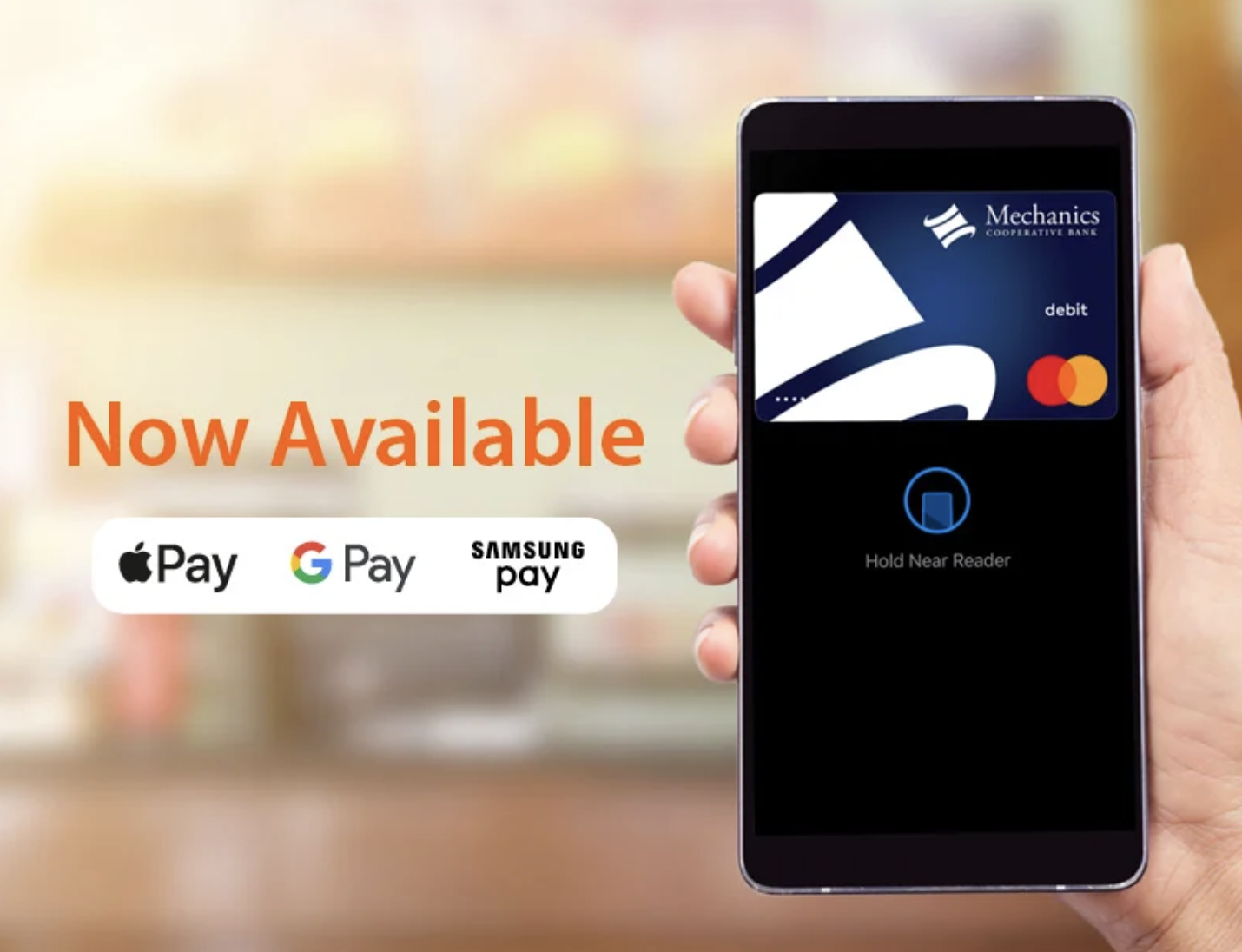

Here at Mechanics Cooperative Bank, we are excited to offer our clients the most up-to-date services, including digital wallet payment method. Our customers now can load their Mechanics Cooperative Bank Debit Card into their mobile device digital wallet and enjoy all benefits of this payment method. Learn more about digital wallets we offer (Apple Pay, Google Pay, Samsung Pay) here.

{{cta(‘1cce2128-9c7d-43bb-b3f8-b7e288d2bc94′,’justifycenter’)}}